Get in touch for a free, no-obligation appointment about how we might be able to help you.

Home » Development Finance » Land Mortgages

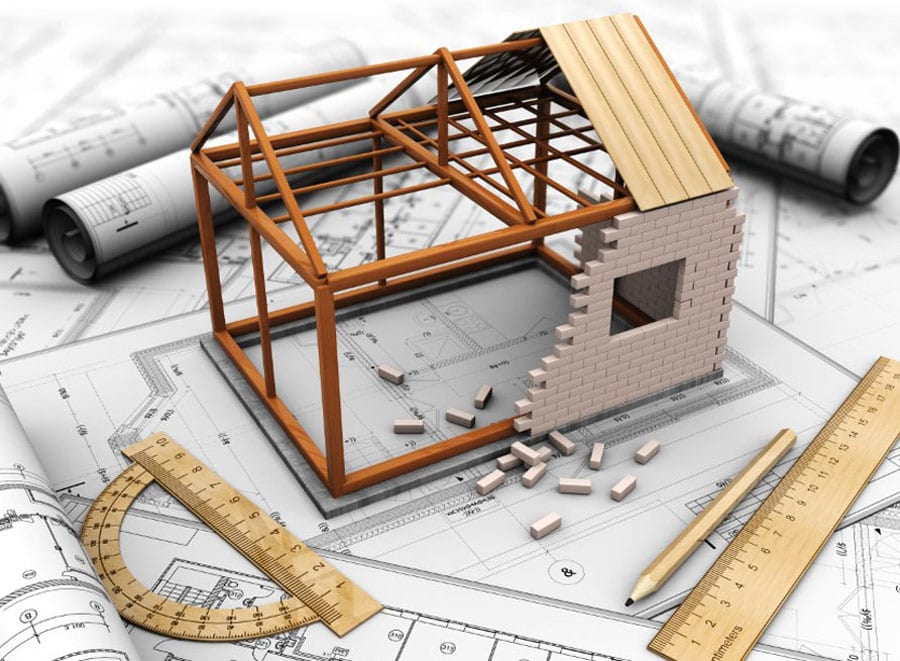

A land mortgage is simply the term for a loan that you use to buy a plot of land rather than a property. They are notoriously difficult to obtain. Whether or not you can get a mortgage to buy land depends on the type of land you purchase and what you intend to use it for.

Your mortgage type will vary depending on what the intended use of your land is. There are four main types of land mortgage:

This is the most common type of mortgage to buy land. You need this type of mortgage in order to build your own residential property. The loan amount is based on the total cost of the land and the property build. The lender usually releases the loan in stages. First of all, the money to purchase the plot of land, and later, you will receive the loan to cover the building materials and labor costs.

An agricultural mortgage is used to purchase agricultural land either for use in business or as an investment. A small plot of agricultural land can sometimes be added to a residential mortgage for private agricultural use. However, sometimes this will also require an agricultural land mortgage.

Some areas of woodland in the UK are available for private sale. These types of plots are unlikely to achieve any planning permission. It is, however, possible to own private woodland, perhaps as a future investment, with a woodland mortgage.

A commercial development mortgage is needed when a business wishes to develop an area of land. This can be for any purpose; however, their intended use is designed to generate a profit rather than for private or residential reasons.

The interest rates on land mortgages are generally higher than standard property-based mortgages. A rate of between 4% and 4.5% is typical, however it will be based on a range of criteria. The intended purpose of the land, your personal credit score, and overall affordability will all affect the interest rates offered.

Due to the high-risk nature of purchasing land, the maximum LTV (loan-to-value amount) a lender will offer is 70%. This means you need to have a minimum deposit of 30% of the land’s total purchase price.

Planning permission is required to change the use of any plot of land. If you already have planning permission, you have a far greater chance of obtaining a mortgage to buy land.

It’s possible to purchase land with planning permission already in place, which most lenders prefer. You can apply for OPP (Outline Planning Permission) or FPP (Full Planning Permission), the latter is more likely to result in acceptance.

Despite any level of planning permission you have in place, the lender will still appoint an independent land surveyor.

Every lender will likely need a detailed financial plan for your development, whether for private residential or commercial use. Cost and time projections will help to secure trust in your project.If your development is for commercial purposes, the lender will require an additional business plan. A strong business plan that fully explains the intended use of land and projected income will put you in good stead.

There is a wide range of places to find available plots of land. In your chosen locality, there may be specialist estate agents and land agents. We still recommend contacting the local authorities and utility companies as well as searching online land databases.

The sale of land in the UK is normally via auction and it’s worth noting that the 10% deposit will be required at the time of purchase. It’s important to ensure land finance is in place prior to attending an auction to buy land.

Land mortgages are possibly the hardest type of mortgage to obtain. Having an experienced commercial mortgage broker to advise you can be instrumental in finding a lender. Lenders offering mortgages for this purpose are in the minority, and making a strong application is essential. Besides reviewing your application and project plans, a mortgage broker will have access to the best deals for land mortgages.

FCA disclaimer

Based on our research, the content contained on this website is accurate as of most recent time of writing. Lending criteria and policies may change regularly so speak to one of the advisors we work with to confirm the most accurate up to date information.

The information on the site is not tailored advice to each individual reader, and as such does not constitute financial advice. All advisors working with us are fully qualified to provide mortgage / financial advice and work only for firms who are authorised and regulated by the Financial Conduct Authority.

They will offer any advice specific to you and your needs. Some types of buy to let, commercial, bridging, mortgages are not regulated by the FCA.

Please think carefully before securing other debts against your home or releasing equity from a property you own. As a mortgage is generally secured against your home or your investment property, it may be repossessed if you do not keep up with repayments on your mortgage.

Member of the National Association of Commercial Finance Brokers (NACFB) Code of Practice.

Sort Commercial Solutions LTD is authorised and regulated by the Financial Conduct Authority under registration number 949625. Registered in England and Wales under registered number 13207282. Registered office: Kemp House 152-160 City Road, London, EC1V 2NX

As part of data protection we are registered with the ICO in the UK – ICO registration number: ZB010823